How the City gets money

Most of the City’s revenue comes from residential and commercial property taxes. We collect additional revenue from the following sources:

- User fees

- Canada Community-Building Fund (Federal Gas Tax)

- Provincial gas tax and revenue transfers

- Fines and penalties

- Payments in lieu of taxes and supplementary taxes

- Investment income and dividends

- Municipal Accommodation Tax

- Recoveries and other revenue

In addition to these sources, we are continuously exploring other ways to generate revenue to offset operating costs.

As Mississauga does not have permission from the Government of Ontario to create new revenue sources, such as the Land Transfer Tax, we are balancing our budget by looking for efficiencies, managing expenses, and increasing revenue from property taxes and user fees.

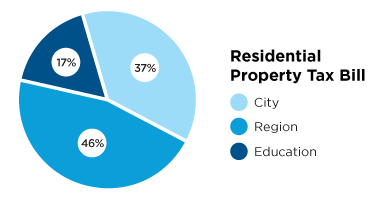

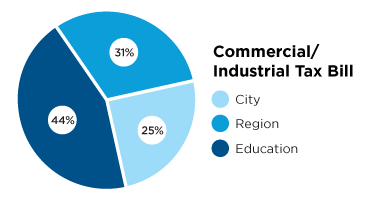

How property taxes are divided

For every property tax dollar collected, roughly one-third stays with the City of Mississauga. The rest is allocated to the Region of Peel and the Government of Ontario’s Ministry of Education to fund regional and provincial services.

For commercial and industrial property taxes, the City receives about a quarter of the total revenue, while the rest is allocated to the Region of Peel and the Government of Ontario.

The services your property taxes fund include the following:

- By-law enforcement

- Culture and Arts

- Economic Development

- Fire and Emergency services

- Library and recreation

- Local Road maintenance

- Parks, Forestry and Environment

- Planning and development

- Transit

- Snow removal

- Tax collection

- Stormwater

- Paramedic services

- Housing

- Police

- Public health

- Regional roads

- Social services

- Waste and recycling

- Water treatment and supply

- Wastewater and treatment

For more information about where, when and how your property taxes are used, learn how the City spends money.

Frequently asked questions

Not necessarily. Every four years, the Municipal Property Assessment Corporation re-assesses all homes in Mississauga. Once we receive the revised property assessments of all properties on our property tax roll from MPAC, we adjust our property tax rates accordingly.

If the value of your home increases in tandem with the average of the whole City, there will be no impact on your tax bill. However, if it increases by more or less than the average, there will be an impact.

If you disagree with your re-assessment, you can ask MPAC to reconsider your assessment. If you don’t agree with MPAC after they have reconsidered, you can appeal to the Assessment Review Board.

Residential tax bills include taxes collected for the Region of Peel, education, and City taxes. This means that only a portion of the increase that will be visible on your 2024 property tax bill is related to the City budget.

The City has adopted a 6.3 per cent increase to the budget, which means a 2.3 per cent increase on the City’s portion of a residential property tax bill. For the owner of an average, detached, single family home in Mississauga (value $730,000), a 2.3 per cent tax increase comes to about $151.

We are working to find savings and efficiencies every year. One way we are strengthening our culture of continuous improvement is through the Lean program.

Lean is an official City program since 2014. It enables us to find efficiencies and new ways to save and invest money and time. This includes purchasing and maintaining tools and equipment to reduce staff time, sorting library materials so that customers can conveniently find what they’re looking for and emailing pet licenses instead of printing and mailing them.

Every year, staff are encouraged to find budgeted cost savings and efficiencies during the budget process. There is $3.7 million cost savings and efficiencies included in the 2024 Budget.

For more information about how we plan and budget, learn how the budget works.